Health Benefits

Be healthy. Choose wisely.

A Closer Look at the HSA

With the $1,500 Deductible Plan, the $2,500 Deductible Plan and the $6,550 Plan, you’re eligible to open and contribute money to a Health Savings Account (HSA). The HSA is a tax-advantaged savings account you can use to help cover the cost of your healthcare.

HSA features:

- Works like a bank account. Pay for eligible healthcare expenses with your debit card when you receive care or reimburse yourself for payments you’ve made (up to the available balance in the account).

- You can save. You decide how much to save and can change that amount at any time. Contribute up to the annual IRS limit of $3,350 for individuals or $6,750 for family coverage. (If you choose the $1,500 or $2,500 Deductible Plan, keep in mind that these limits include Kindred’s contribution.) Additional contributions of up to $1,000 are allowed for employees age 55+.

- Never pay taxes. Contributions are made from your paycheck on a pre-tax basis, and the money will never be taxed when used for eligible expenses.

- It’s your money. Unused money can be carried over each year and invested for the future—you can even take it with you if you leave your job. If you participated in an HSA last year, you can also roll over those funds into your new HSA. Visit the Kindred Benefits Marketplace for more information.

- Can be paired with a Limited Purpose Flexible Spending Account (FSA). Combine the two accounts for additional tax savings. Only dental and vision expenses are allowed from the Limited Purpose FSA.

Kindred will make a company contribution to your HSA if you enroll in either the $1,500 or $2,500 Deductible Plan. Receive $150 for employee-only coverage and $300 for all other coverage levels, divided into equal amounts and deposited each pay period over the course of the year.

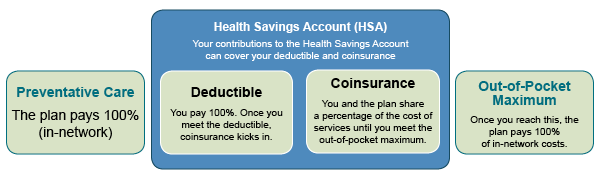

How Your Plan and HSA Work Together

Who is Eligible?

- You must be enrolled in an HSA-eligible plan

- You cannot be covered by any other healthcare plan that is not an HSA-eligible plan

- You cannot be enrolled in Medicare or Tricare

- You cannot be covered by a healthcare FSA (other than for limited benefits only like dental or vision) or a health reimbursement account (HRA)

- You cannot be claimed as a tax dependent on someone else's tax return

- You cannot have received Veterans Administration (VA) benefits within the past three months

You can use your HSA for out-of-pocket expenses like:

- Deductibles

- Coinsurance

- Office visits

- Prescription drugs

- Hospital stays and lab work

- Speech/occupational/physical therapy

- Dental and vision care

For a complete list of eligible expenses, go to IRS Publication 502.

Need help with the terms on this page? Visit the Glossary.

Note: If you currently have an HSA, you will be able to transfer your balance using the HSA Rollover Form. This form can be found in the Resources section of the Kindred Benefits Marketplace.